Bitcoin and other cryptocurrencies have exploded onto the scene, capturing the attention of investors and disrupting traditional financial systems. This comprehensive guide delves into the world of Bitcoin and crypto, exploring its fundamentals, mechanics, investment strategies, and future prospects. We’ll uncover the underlying technology, blockchain, and its profound impact beyond digital currencies.

From the historical development of Bitcoin to its intricate transaction processes, we’ll provide a detailed overview of the technology behind cryptocurrencies. The guide also examines various cryptocurrencies beyond Bitcoin, highlighting their unique features and applications. Furthermore, we’ll explore the practical aspects of buying Bitcoin, including different methods, potential risks, and strategies for managing investment.

Introduction to Bitcoin and Cryptocurrencies

Bitcoin and other cryptocurrencies represent a revolutionary shift in how we think about money and digital transactions. They operate independently of traditional financial institutions, utilizing decentralized networks and cryptographic principles to facilitate secure and transparent transactions. Understanding these systems is key to navigating this evolving landscape.Bitcoin, the first and most well-known cryptocurrency, emerged in 2009 as a response to concerns about centralized control over money.

Its creation, attributed to a person or group known as Satoshi Nakamoto, sought to establish a peer-to-peer electronic cash system. This decentralized approach avoids intermediaries like banks, offering potential benefits in terms of reduced transaction fees and increased accessibility.

Fundamental Concepts of Bitcoin and Cryptocurrencies

Cryptocurrencies are digital or virtual currencies designed to work as a medium of exchange. They utilize cryptography for security and control, enabling secure transactions without the need for intermediaries. These digital assets are typically decentralized, meaning they are not controlled by a single entity, government, or institution. Instead, they rely on a distributed ledger technology called blockchain to record and verify transactions.

Historical Overview of Bitcoin’s Development

Bitcoin’s development was a gradual process, marked by initial skepticism and subsequent growth in adoption. Early adopters saw Bitcoin as a potential alternative to traditional financial systems, while others viewed it as a speculative asset. The evolution of Bitcoin has seen periods of significant price fluctuations, demonstrating its volatility as an investment. Over time, regulatory frameworks and mainstream acceptance have emerged as the technology matures.

Core Differences Between Bitcoin and Other Cryptocurrencies

Bitcoin’s unique features set it apart from other cryptocurrencies. While most cryptocurrencies share the underlying blockchain technology, they often differ in their intended use cases, underlying consensus mechanisms, and scalability. For instance, Bitcoin prioritizes its function as a medium of exchange, while other cryptocurrencies may focus on smart contracts or decentralized applications.

Key Features and Characteristics of Various Cryptocurrencies

Understanding the differences between cryptocurrencies requires examining their key characteristics. This table Artikels some prominent cryptocurrencies and their distinguishing features:

| Cryptocurrency |

Purpose |

Consensus Mechanism |

Scalability |

| Bitcoin (BTC) |

Digital currency, peer-to-peer electronic cash |

Proof-of-Work |

Relatively low |

| Ethereum (ETH) |

Decentralized platform for applications and smart contracts |

Proof-of-Stake |

Higher than Bitcoin, but still facing challenges |

| Litecoin (LTC) |

Alternative digital currency, aiming for faster transactions |

Proof-of-Work |

Higher than Bitcoin |

Underlying Technology (Blockchain) and its Significance

Blockchain is a distributed, immutable ledger that records transactions across multiple computers. Its decentralized nature ensures transparency and security, making it a cornerstone of cryptocurrency systems. Each block in the blockchain contains a set of transactions, linked chronologically and cryptographically to the previous block. This ensures the integrity and immutability of the transaction history. The security and transparency offered by blockchain have broader implications beyond cryptocurrencies, potentially revolutionizing various industries.

How Bitcoin Works

Bitcoin operates as a decentralized digital currency, relying on a distributed ledger known as the blockchain. This system facilitates secure and transparent transactions without intermediaries. Unlike traditional financial systems, Bitcoin transactions aren’t processed through banks or other central authorities.Bitcoin’s unique structure relies on cryptographic principles and a network of computers to verify and record transactions. This decentralized approach contributes to the security and immutability of the Bitcoin ledger.

Bitcoin Transaction Mechanics

Bitcoin transactions are fundamentally records of value transfers between addresses. These addresses are essentially unique identifiers, like digital wallets, used to track and control Bitcoin ownership. Each transaction includes details like the sender’s address, the recipient’s address, and the amount being transferred. Crucially, these transactions are cryptographically signed, ensuring their authenticity and preventing fraudulent alterations.

Creating Bitcoin Transactions

Creating a Bitcoin transaction involves several steps. First, the sender initiates the transaction by specifying the recipient’s address and the amount to be sent. Next, this transaction is digitally signed using the sender’s private key, a unique cryptographic code that acts as a digital signature. This signature verifies the sender’s identity and authorization to make the transfer.

This digitally signed transaction is then broadcast to the Bitcoin network.

Verifying Bitcoin Transactions

Bitcoin’s network of computers, known as nodes, verifies the authenticity of transactions. These nodes independently validate the transactions, ensuring they comply with Bitcoin’s rules and regulations. Verification involves checking the sender’s balance to ensure they have enough funds, confirming the validity of the digital signature, and verifying that the transaction hasn’t been previously recorded on the blockchain.

The Role of Mining in Bitcoin

Bitcoin’s security relies on a process called mining. Miners solve complex mathematical problems to add new blocks of transactions to the blockchain. This process is crucial for securing the network and adding new transactions to the chain. Mining rewards miners with newly created Bitcoins as an incentive for maintaining the network. This mechanism also prevents single points of failure and promotes decentralization.

Decentralization in Bitcoin’s Architecture

Bitcoin’s decentralization is a key feature. No single entity controls the Bitcoin network. Instead, the network is distributed across thousands of computers globally, making it resistant to censorship or single points of failure. This decentralized nature ensures the network’s continued operation even if some nodes fail or are compromised.

Step-by-Step Guide to Bitcoin Transaction Processing

| Step |

Description |

| 1 |

Initiation: The sender creates a transaction with the recipient’s address and amount. |

| 2 |

Digital Signature: The sender uses their private key to digitally sign the transaction, proving ownership and authorization. |

| 3 |

Broadcast: The signed transaction is broadcast to the Bitcoin network. |

| 4 |

Verification: Network nodes validate the transaction, checking the sender’s balance, signature validity, and for double-spending attempts. |

| 5 |

Inclusion in a Block: Once verified, the transaction is included in a new block by a miner. |

| 6 |

Block Addition to Blockchain: The new block is added to the existing blockchain, permanently recording the transaction. |

Understanding Cryptocurrencies Beyond Bitcoin

Bitcoin, while groundbreaking, is just one piece of a much larger puzzle. The cryptocurrency landscape is diverse, with numerous alternative coins emerging, each possessing unique features and applications. This exploration delves into the multifaceted world of cryptocurrencies beyond Bitcoin, highlighting their distinct characteristics and use cases.

Types of Cryptocurrencies

Beyond Bitcoin, a wide array of cryptocurrencies exist, each with varying functionalities. These include altcoins, designed to address perceived limitations of Bitcoin or introduce new functionalities. Some focus on speed, others on security, and still others on specific use cases like stablecoins or decentralized finance (DeFi) tokens. Understanding the variety is crucial for evaluating potential investments and applications.

Use Cases and Applications

Cryptocurrencies, beyond Bitcoin, are not confined to simple payment systems. They are employed in various contexts, ranging from decentralized applications (dApps) that facilitate peer-to-peer transactions to specialized platforms for financial instruments. Stablecoins, for instance, aim to mitigate the volatility of traditional cryptocurrencies by pegging their value to a stable asset like the US dollar. The unique functionalities and applications of each coin contribute to the overall ecosystem.

Comparison of Cryptocurrencies

Different cryptocurrencies possess varying strengths and weaknesses. Some boast higher transaction speeds, while others prioritize enhanced security or lower transaction fees. Factors like market capitalization, community support, and development teams play a role in determining a coin’s potential. Thorough analysis of these factors is critical for informed decision-making.

Key Characteristics and Applications of Popular Cryptocurrencies

| Cryptocurrency |

Key Characteristics |

Primary Applications |

| Ethereum (ETH) |

Decentralized platform for smart contracts and dApps; programmable blockchain |

Decentralized finance (DeFi), non-fungible tokens (NFTs), and various applications requiring smart contract functionality |

| Litecoin (LTC) |

Faster transaction speeds compared to Bitcoin; often used for smaller transactions |

Peer-to-peer payments, microtransactions, and applications requiring quick settlement times |

| Tether (USDT) |

Stablecoin pegged to the US dollar; aims to provide price stability |

Transactions within cryptocurrency exchanges, hedging against price volatility, and facilitating stable value-preserving transactions |

| Cardano (ADA) |

Focus on scalability and sustainability; designed for future-proof development |

Decentralized applications, smart contracts, and wider use cases within the blockchain space |

Blockchain Beyond Cryptocurrencies

Blockchain technology, while initially associated with cryptocurrencies, has found applications in diverse sectors. Supply chain management, where tracking goods from origin to consumer, benefits from blockchain’s immutability and transparency. Voting systems can use blockchain for secure and verifiable elections. Healthcare records can be stored and accessed securely using blockchain technology. This broader adoption showcases the versatility of the underlying technology.

Buying Bitcoin

Purchasing Bitcoin involves navigating a landscape of digital platforms and security considerations. Understanding the various methods, associated risks, and security protocols is crucial for a smooth and secure experience. The process, while seemingly straightforward, requires vigilance and a grasp of the potential pitfalls.

Methods for Acquiring Bitcoin

Various methods facilitate Bitcoin purchases, each with its own set of advantages and disadvantages. Choosing the right approach depends on individual needs and comfort levels.

- Cryptocurrency Exchanges: These platforms are central hubs for trading various cryptocurrencies, including Bitcoin. They offer a wide range of trading options, often with user-friendly interfaces and a broad range of support services. Exchanges generally provide robust security measures to protect user funds, but risks like hacking and operational failures are ever-present. Examples include Coinbase, Kraken, and Binance.

- Cryptocurrency Brokers: These intermediaries connect buyers and sellers of cryptocurrencies, similar to traditional brokerage platforms. They frequently offer lower fees compared to exchanges, although the selection of cryptocurrencies might be more limited. They typically provide access to a broader range of financial instruments and potentially higher leverage. Some brokers might also include educational resources and customer support. Examples include eToro and Fidelity.

- Peer-to-Peer (P2P) Platforms: These platforms facilitate direct transactions between buyers and sellers. This method can potentially lead to lower fees compared to exchanges, as intermediaries are bypassed. However, the lack of regulatory oversight and the inherent trust required can increase the risk of fraud and scams. Buyers must conduct thorough due diligence before transacting.

- Over-the-Counter (OTC) Markets: These specialized markets cater to larger transactions, typically involving institutional investors. They can offer customized pricing and tailored services but often come with higher fees and require more experience in navigating the intricacies of the market.

Comparing Platforms

Choosing the right platform for purchasing Bitcoin depends on factors like transaction fees, security measures, available features, and the specific needs of the buyer.

| Platform |

Pros |

Cons |

| Exchanges |

Wide selection of cryptocurrencies, user-friendly interfaces, robust security measures (often). |

Potentially higher fees, dependence on platform stability. |

| Brokers |

Lower fees compared to exchanges, access to broader financial instruments. |

Limited selection of cryptocurrencies, potential for high leverage. |

| P2P |

Lower fees, direct transactions. |

Higher risk of scams, lack of regulatory oversight, requires significant due diligence. |

| OTC |

Customized pricing, tailored services. |

Higher fees, experience required, limited accessibility. |

Security Measures

Implementing robust security measures is paramount when purchasing Bitcoin.

- Strong Passwords: Use strong, unique passwords for all accounts associated with cryptocurrency transactions.

- Two-Factor Authentication (2FA): Enable 2FA wherever possible to add an extra layer of security to your accounts.

- Regular Account Monitoring: Actively monitor your accounts for any unusual activity.

- Secure Hardware Wallets: Consider using hardware wallets to store your Bitcoin offline for enhanced security.

Risks Involved

Buying and selling Bitcoin comes with inherent risks.

- Market Volatility: Bitcoin’s price fluctuates significantly, exposing investors to potential losses. Past performance is not indicative of future results.

- Security Risks: Platforms can be vulnerable to hacking or fraud, leading to the loss of funds.

- Regulatory Uncertainty: Cryptocurrency regulations are still evolving in many jurisdictions, creating potential legal and compliance challenges.

- Scams and Fraud: Be wary of scams and fraudulent schemes that attempt to trick investors into losing their funds.

Flowchart: Buying Bitcoin

| Step |

Action |

| 1 |

Research various Bitcoin buying platforms (exchanges, brokers, P2P). |

| 2 |

Choose a platform based on your needs and risk tolerance. |

| 3 |

Create an account and verify your identity. |

| 4 |

Deposit funds into your account. |

| 5 |

Place an order to purchase Bitcoin. |

| 6 |

Monitor the transaction and ensure confirmation. |

| 7 |

Store your Bitcoin securely (e.g., in a wallet). |

Risks and Rewards of Investing in Bitcoin

Bitcoin, while offering potential for significant returns, presents substantial risks for investors. Understanding these risks and rewards is crucial for making informed decisions. The inherent volatility of the market and the decentralized nature of the cryptocurrency introduce complexities that are absent in traditional financial instruments.The allure of substantial profits has attracted many investors to Bitcoin. However, the potential for substantial losses must also be considered.

The unpredictable price fluctuations can lead to significant capital erosion if not carefully managed.

Potential Risks of Bitcoin Investment

Investment in Bitcoin, like any other speculative asset, carries inherent risks. Understanding these risks is crucial for effective risk management. Market volatility, regulatory uncertainty, and technological vulnerabilities are among the key concerns.

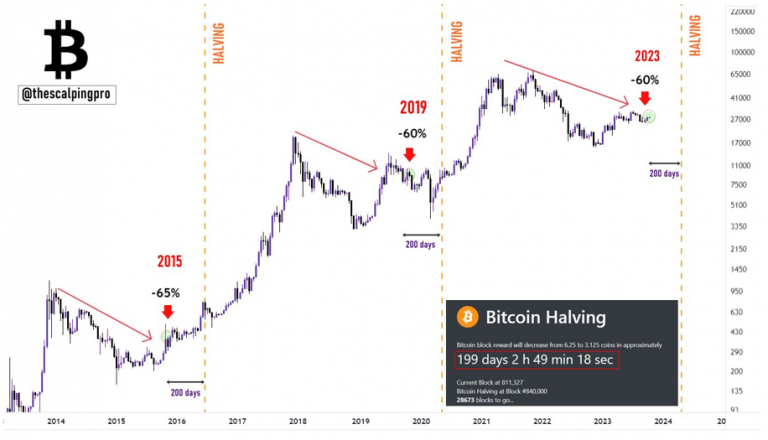

- Market Volatility: Bitcoin prices are notoriously volatile, exhibiting significant fluctuations over short periods. This inherent instability can lead to substantial losses for investors who are not prepared for such fluctuations. Past examples show that prices can experience drastic swings, both upwards and downwards. For instance, the price of Bitcoin has seen significant peaks and valleys throughout its history, sometimes leading to substantial losses for those holding Bitcoin when the price plummets.

- Regulatory Uncertainty: The lack of consistent regulatory frameworks across different jurisdictions can create uncertainty about the future of Bitcoin. Changes in regulations can significantly impact the value and accessibility of Bitcoin investments. Varying regulatory approaches across countries and regions make it difficult for investors to predict the future of Bitcoin.

- Technological Risks: Bitcoin’s underlying technology, blockchain, is complex. Vulnerabilities in the network, security breaches, and unforeseen technical issues can disrupt operations and potentially lead to significant financial losses. The security of the blockchain network is essential to maintain confidence in Bitcoin as a store of value. However, security vulnerabilities, such as hacking attempts or software bugs, can disrupt operations and create significant financial risks.

- Security Risks: Investors must protect their Bitcoin holdings from theft or loss. Security breaches and inadequate storage solutions can lead to significant financial losses. It is crucial for investors to understand and practice secure methods for storing their Bitcoin, including using strong passwords, enabling two-factor authentication, and choosing secure storage solutions.

Potential Rewards of Bitcoin Investment

Despite the inherent risks, Bitcoin offers potential rewards. The potential for high returns, the potential for early adoption benefits, and the increasing institutional interest are factors to consider.

- High Potential Returns: Bitcoin’s history showcases periods of substantial price appreciation, attracting investors seeking high returns. While past performance is not indicative of future results, the potential for significant gains is a key motivator for many investors.

- Early Adoption Benefits: Early investors in Bitcoin have often benefited from significant gains as the cryptocurrency gained wider adoption. However, early investors also face higher risks due to the unpredictable nature of emerging markets.

- Growing Institutional Interest: Increased institutional interest in Bitcoin suggests growing legitimacy and potential for sustained growth. However, institutional adoption is a gradual process and requires careful consideration by investors.

Examples of Successful and Unsuccessful Bitcoin Investments

Real-world examples illustrate the variability of Bitcoin investment outcomes. These examples highlight the potential for substantial gains, but also the potential for substantial losses.

- Successful Investments: Numerous individuals and institutions have reported substantial profits from Bitcoin investments, capitalizing on periods of price appreciation. These successes often rely on in-depth market research and careful risk management.

- Unsuccessful Investments: Conversely, numerous investors have experienced significant losses due to market fluctuations or poor investment strategies. Poor timing and lack of risk management often contribute to these unsuccessful ventures.

Bitcoin Price Volatility

Bitcoin’s price fluctuations are a significant concern for investors. Understanding the factors driving these fluctuations is crucial for informed decision-making.

- Market Sentiment: Investor confidence and enthusiasm significantly influence Bitcoin’s price. Sudden shifts in sentiment can lead to rapid price changes.

- Regulatory Changes: News regarding regulations, both positive and negative, can trigger substantial price movements.

- Technological Advancements: Technological developments in the blockchain and cryptocurrency space can affect investor confidence and thus price.

Strategies for Managing Bitcoin Investment Risks

Effective risk management strategies are crucial for mitigating potential losses. Diversification, stop-loss orders, and continuous learning are important aspects.

- Diversification: Diversifying investments across different cryptocurrencies or other asset classes can help mitigate risks associated with a single asset.

- Stop-Loss Orders: Using stop-loss orders can help limit potential losses by automatically selling Bitcoin when the price reaches a predetermined level.

- Continuous Learning: Staying informed about market trends, regulatory changes, and technological advancements is crucial for effective risk management.

Evaluating Potential Investment Opportunities in Bitcoin

Thorough research and careful analysis are essential when evaluating Bitcoin investment opportunities.

- Thorough Research: Comprehensive research into market trends, regulatory landscapes, and technological advancements is crucial.

- Risk Assessment: A detailed risk assessment of potential investment opportunities is vital to understanding the possible downside scenarios.

- Realistic Expectations: Maintaining realistic expectations about Bitcoin’s potential returns is essential to avoiding disappointment.

Bitcoin and the Future

Bitcoin’s trajectory and the future of cryptocurrencies are subjects of intense speculation and analysis. While the technology behind Bitcoin and other cryptocurrencies is undeniably innovative, its future success depends on several factors, including regulatory clarity, broader adoption, and the resolution of inherent challenges. The potential for significant growth, however, remains substantial.

Potential Future Scenarios

The future of Bitcoin and cryptocurrencies is not predetermined. Several potential scenarios exist, each with its own set of implications. The technology itself is evolving, and external factors like global economic trends and government regulations will influence the direction. A range of outcomes is possible, from widespread adoption to niche applications.

Potential for Widespread Adoption

The increasing acceptance of cryptocurrencies by businesses and individuals suggests a path towards wider adoption. Payment platforms are integrating cryptocurrencies, and institutional investors are showing more interest. This growing acceptance could lead to Bitcoin becoming a mainstream payment method. Examples include the increasing use of cryptocurrencies for international transactions and the emergence of decentralized finance (DeFi) platforms, which are creating new financial opportunities.

Potential for Niche Applications

While mainstream adoption is a possibility, cryptocurrencies could also find specialized applications in areas like supply chain management, digital identity, and microtransactions. These niche uses could lead to the creation of new industries and value propositions. For instance, decentralized storage solutions could revolutionize data management, and the use of cryptocurrencies in voting systems could increase transparency and security.

Regulatory Frameworks and their Impact

Governments worldwide are grappling with how to regulate cryptocurrencies. A consistent global regulatory framework is crucial for the growth and legitimacy of the industry. Potential frameworks could include licensing requirements, anti-money laundering (AML) regulations, and tax policies. The specific regulatory approach will significantly influence the future trajectory of cryptocurrencies. A lack of clarity and consistency could lead to market volatility and investor hesitancy.

Conversely, well-defined regulations could foster trust and promote innovation.

Potential Impact on Various Industries

| Industry |

Potential Impact |

| Finance |

Increased efficiency in cross-border payments, new investment opportunities, potentially disrupting traditional banking models. |

| E-commerce |

New payment options for consumers, potentially lowering transaction fees, fostering global reach for businesses. |

| Supply Chain |

Enhanced transparency and security in supply chains, potential for reduced fraud and counterfeiting. |

| Gaming |

New ways for players to earn and spend virtual currency, opportunities for creating decentralized games and platforms. |

| Digital Arts |

New avenues for artists to monetize their work, possibilities for establishing a fair and transparent market. |

The table above Artikels some potential impacts of Bitcoin on various industries. These are just examples, and the actual impact will depend on how cryptocurrencies are adopted and regulated. The development of new applications and use cases could also lead to unforeseen impacts.

Related Concepts

Bitcoin and its associated technologies are built upon a complex network of concepts. Understanding these concepts is crucial for navigating the world of cryptocurrencies and making informed decisions. From the fundamental components of transactions to the intricate mechanisms supporting the network, this section delves into key related concepts.

Bitcoin Wallets, Addresses, and Keys

Bitcoin wallets act as digital containers for storing private keys and associated public addresses. They allow users to send and receive Bitcoin transactions. A Bitcoin address is a unique alphanumeric string that functions as a recipient’s account. This address is generated from a private key, which is a randomly generated, secret string of characters. These private keys are essential for accessing and controlling funds held within a Bitcoin wallet.

Secure storage of these keys is paramount to protect your Bitcoin holdings.

Bitcoin Exchanges

Bitcoin exchanges are online platforms that facilitate the buying, selling, and trading of Bitcoin and other cryptocurrencies. These platforms connect buyers and sellers, allowing them to execute transactions efficiently and securely. Exchanges typically employ robust security measures to protect user funds and transactions. A critical function of exchanges is providing liquidity, enabling users to easily convert Bitcoin into fiat currency and vice-versa.

Mining Rewards and Bitcoin’s Ecosystem

Bitcoin mining is the process of verifying and adding new transactions to the blockchain. Miners are rewarded with newly created Bitcoin for their computational efforts. These rewards incentivize participation in the Bitcoin network, maintaining its security and integrity. The mining reward mechanism has a significant impact on Bitcoin’s long-term supply and network dynamics. The reward halving events are crucial milestones that affect the rate at which new Bitcoin enters circulation.

Bitcoin Wallet Types and Security

Bitcoin wallets come in various forms, each with its own set of security features. Software wallets, accessible via computers or mobile devices, offer user-friendly interfaces but require vigilance against malware and phishing attempts. Hardware wallets, like physical devices, provide a robust layer of security by storing private keys offline. Paper wallets, using printed addresses and private keys, offer the ultimate in offline storage, but are highly vulnerable to loss or damage.

The choice of wallet type often depends on the user’s risk tolerance and technical expertise.

Secure Bitcoin Storage

Securing Bitcoin holdings is crucial. A multi-signature wallet, requiring multiple private keys for authorization, is a potent way to increase security. Cold storage, keeping private keys offline, is a cornerstone of Bitcoin security. Using strong passwords and enabling two-factor authentication (2FA) are vital for software wallets. Regularly backing up wallets and maintaining updated software are crucial preventative measures.

Storing Bitcoin in a diversified portfolio alongside other assets is another crucial consideration.

Ultimate Conclusion

In conclusion, Bitcoin and cryptocurrencies represent a significant shift in the global financial landscape. While opportunities abound, potential risks must also be acknowledged. This guide has provided a comprehensive overview, empowering readers to navigate the complexities of this dynamic space with informed decision-making. The future of Bitcoin and crypto is uncertain, but its potential impact on various sectors is undeniable.

FAQ Guide

What is the difference between Bitcoin and other cryptocurrencies?

Bitcoin, often considered the pioneer, utilizes a specific blockchain structure. Other cryptocurrencies, like Ethereum, often build upon or deviate from this model, introducing different functionalities and use cases. Their differences often lie in their underlying technologies and intended applications.

What are the main risks associated with buying and selling Bitcoin?

Volatility is a significant risk, as Bitcoin prices can fluctuate dramatically. Security risks exist, particularly with custodial wallets or exchanges. Regulation is another factor, as it can impact the future value and accessibility of Bitcoin.

How does blockchain technology work?

Blockchain is a distributed, immutable ledger that records transactions across multiple computers. This decentralized nature enhances security and transparency. Each transaction is grouped into a “block,” and these blocks are linked together chronologically, forming a chain. This makes it extremely difficult to alter or tamper with transaction history.