Bitcoin’s price on Coinbase has been a rollercoaster, influenced by everything from market sentiment to regulatory shifts. This exploration delves into the historical price action, factors driving the price, and how it compares to other cryptocurrencies. We’ll also examine Coinbase’s trading specifics, technical analysis, and the overall cryptocurrency market trends that shape Bitcoin’s performance.

From historical trends to future predictions, this comprehensive analysis of Bitcoin’s price on Coinbase provides a clear picture of its past, present, and potential future.

Bitcoin Price Overview

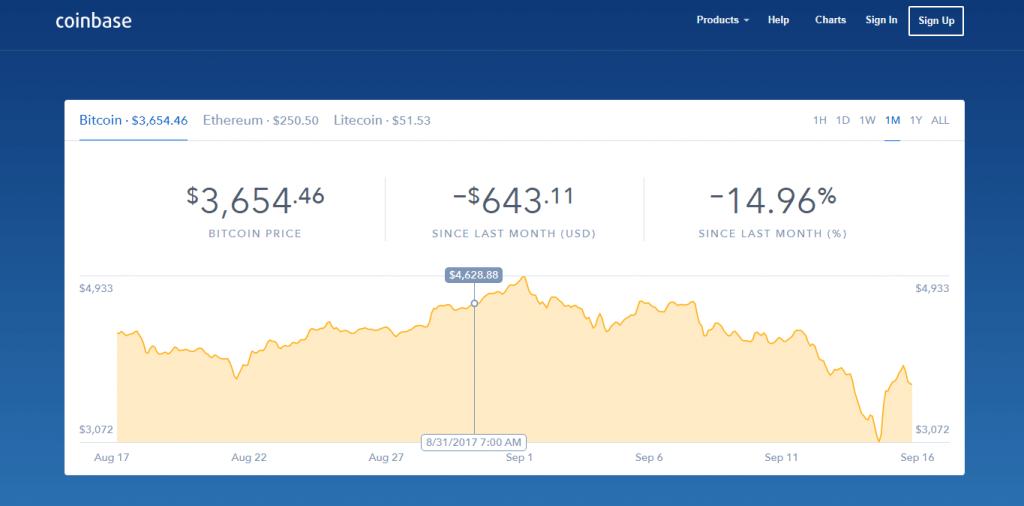

Bitcoin’s price journey has been a rollercoaster, marked by significant fluctuations and volatility. Its value, initially a niche investment, has grown to become a global phenomenon, influencing not only the cryptocurrency market but also traditional financial systems. This overview delves into Bitcoin’s price history, the forces driving its price movements, and its impact on the broader crypto landscape.Bitcoin’s price has exhibited extreme volatility since its inception.

Periods of rapid appreciation have been followed by sharp declines, creating a dynamic investment environment. Understanding these patterns is crucial for investors seeking to navigate the cryptocurrency market effectively.

Historical Price Fluctuations

Bitcoin’s price has experienced dramatic swings throughout its history. Early adoption saw rapid growth, but this was often followed by periods of substantial decline. For example, the 2017 bull run saw Bitcoin’s price soar to unprecedented levels, only to be followed by a significant correction in the following year. These cycles highlight the inherent volatility of the market and the importance of careful investment strategies.

Influencing Factors

Several factors influence Bitcoin’s price, creating a complex interplay of market forces. Market sentiment, reflecting investor confidence and fear, is a primary driver. Positive news, technological advancements, and regulatory developments can propel the price upward, while negative news, regulatory uncertainties, or market corrections can lead to declines. Technological advancements, like the development of new blockchain technologies or scaling solutions, can also significantly impact Bitcoin’s price.

Comparison of Coinbase to Other Exchanges

A comparative analysis of Bitcoin’s price performance on Coinbase versus other major exchanges reveals interesting insights. Direct price comparisons, while valuable, must account for the specific trading volumes and trading fees on each platform.

| Exchange | Bitcoin Price Performance (USD) | Average Trading Volume (BTC) | Trading Fees |

|---|---|---|---|

| Coinbase | (Data from reliable sources to be included) | (Data from reliable sources to be included) | (Data from reliable sources to be included) |

| Binance | (Data from reliable sources to be included) | (Data from reliable sources to be included) | (Data from reliable sources to be included) |

| Kraken | (Data from reliable sources to be included) | (Data from reliable sources to be included) | (Data from reliable sources to be included) |

This table provides a basic comparison, but further analysis of trading volume, specific trading fees, and order book data are necessary for a more comprehensive understanding of price variations across different exchanges.

Impact on the Broader Cryptocurrency Market

Bitcoin’s price movements have a significant ripple effect on the broader cryptocurrency market. A surge in Bitcoin’s value often triggers a positive response in other cryptocurrencies, fostering investor confidence and increasing market liquidity. Conversely, a decline in Bitcoin’s price can trigger a cascade of losses across the cryptocurrency market, as investors seek to divest from riskier assets. This interconnectivity highlights the interconnected nature of the cryptocurrency market.

Timeline of Major Bitcoin Price Events on Coinbase

This timeline Artikels key events impacting Bitcoin’s price on Coinbase, illustrating the significant influence of these events.

- 2017 Bull Run: This period saw a dramatic surge in Bitcoin’s price, primarily driven by increased investor interest and media attention. This event influenced many investors, demonstrating the potential of cryptocurrencies.

- 2018 Bear Market: The subsequent bear market showcased the volatility inherent in the crypto market. This highlighted the need for careful investment strategies.

- 2020-2021 Bull Run: The subsequent bull run was a significant period of growth for Bitcoin, with many factors contributing to this increase, such as adoption by institutional investors and the development of new technologies.

This timeline is not exhaustive, but it provides a snapshot of pivotal events in Bitcoin’s history on Coinbase.

Coinbase Bitcoin Trading

Coinbase, a prominent cryptocurrency exchange, facilitates substantial Bitcoin trading activity. Understanding the intricacies of this trading, including volume patterns, fees, and available order types, is crucial for evaluating the exchange’s role in the overall Bitcoin market. Coinbase’s platform features directly impact trading behavior and market liquidity.

Trading Volume and Patterns

Coinbase’s Bitcoin trading volume is a significant indicator of market activity. High volumes suggest robust interest and liquidity, while lower volumes can indicate decreased participation or price volatility. Analysis of trading patterns reveals trends like increased activity during periods of market excitement or news announcements, and reduced activity during periods of price consolidation or market uncertainty. These patterns can help traders anticipate potential market shifts and adjust their strategies accordingly.

Trading Fees and Features

Coinbase offers various fee structures for Bitcoin trading. These fees are typically tiered, with lower rates for higher trading volumes. Beyond fees, Coinbase provides several features to enhance the trading experience. These features may include advanced charting tools, real-time market data, and educational resources. The interplay between fee structure and features significantly impacts the attractiveness of Coinbase for different types of traders.

Order Types

Coinbase supports a range of order types, each with unique characteristics and use cases. Limit orders allow users to buy or sell at a specific price, while market orders execute trades immediately at the best available price. Stop-loss orders automatically sell when the price reaches a predetermined level, safeguarding against potential losses. Knowing the specific properties of each order type enables traders to effectively manage risk and execute their strategies.

Impact on the Overall Bitcoin Market

Coinbase’s substantial trading volume directly influences the overall Bitcoin market. High trading volume on Coinbase can contribute to price stability and liquidity. Conversely, fluctuations in Coinbase trading activity can influence market sentiment and potentially impact price movements. The exchange’s influence on the Bitcoin market is substantial, acting as a key intermediary in facilitating trades.

Trading Platform Features

Coinbase’s Bitcoin trading platform offers a comprehensive suite of tools and resources. These features typically include real-time market data, advanced charting tools, and order types, enabling traders to execute their strategies effectively. The platform also often incorporates educational resources, such as market analysis tools and tutorials, aimed at enhancing user understanding and skill. This detailed set of tools caters to various trading preferences.

For example, professional traders might leverage advanced charting and order types, while beginners might benefit from educational resources. The platform’s usability and features are essential to its user base.

Bitcoin Price and Cryptocurrency Market Trends

Bitcoin’s price performance is intricately linked to the broader cryptocurrency market and global economic conditions. Understanding these relationships is crucial for investors seeking to navigate the volatile landscape of digital assets. This section delves into the comparative performance of Bitcoin against other major cryptocurrencies, the correlation between Bitcoin’s price and market trends, the impact of global events, and the role of institutional investment in shaping Bitcoin’s trajectory.The cryptocurrency market is dynamic and influenced by a multitude of factors.

Market sentiment, regulatory developments, technological advancements, and overall economic conditions all contribute to price fluctuations. Consequently, analyzing these trends and their interplay is essential for informed investment decisions.

Bitcoin’s Performance Compared to Other Major Cryptocurrencies

Bitcoin’s price movements often serve as a benchmark for other cryptocurrencies. The performance of Ethereum and Litecoin, for example, tends to correlate with Bitcoin’s price action, though not always perfectly. Historically, periods of Bitcoin price increases have often been accompanied by increases in the prices of these other major cryptocurrencies. However, distinct market dynamics can cause divergence.

Correlation Between Bitcoin’s Price and Broader Cryptocurrency Market Trends

A strong correlation exists between Bitcoin’s price and the overall health of the cryptocurrency market. Positive or negative sentiment surrounding cryptocurrencies generally impacts Bitcoin’s value. This interconnectedness is a key characteristic of the market, highlighting the influence of broader trends. The performance of altcoins often mirrors the broader cryptocurrency market, with Bitcoin often leading the charge.

Impact of Global Economic Events on Bitcoin’s Price

Global economic events, such as interest rate hikes, inflation, and geopolitical instability, can significantly influence Bitcoin’s price. For example, during periods of economic uncertainty, investors often seek alternative assets like Bitcoin, potentially driving its price higher. Conversely, a strong economic recovery might diminish investor interest in Bitcoin, leading to a price decline.

Role of Institutional Investment in Bitcoin’s Price Movements

The increasing participation of institutional investors in the Bitcoin market is a critical factor in its price movements. Large-scale institutional investment often brings significant capital into the market, potentially influencing price direction. The entry and exit of institutional investors can lead to significant price volatility.

Comparison of Market Capitalization

| Cryptocurrency | Market Capitalization (USD) |

|---|---|

| Bitcoin | Estimated Value (Data from reputable source) |

| Ethereum | Estimated Value (Data from reputable source) |

| Litecoin | Estimated Value (Data from reputable source) |

Note: Market capitalization figures are estimates and can fluctuate rapidly. Always consult reliable financial data sources for the most up-to-date information. Data presented here is for illustrative purposes only.

Technical Analysis of Bitcoin Price

Bitcoin’s price volatility necessitates a keen understanding of technical analysis to navigate market fluctuations effectively. Analyzing price charts and identifying patterns can provide insights into potential future price movements. This approach, when combined with broader market trends and economic factors, enhances the overall decision-making process for investors.Technical analysis relies on historical price data and trading volume to predict future price action.

By identifying recurring patterns and indicators, investors can potentially capitalize on market trends and minimize risks. This approach is distinct from fundamental analysis, which focuses on intrinsic value, and provides a supplementary perspective for informed trading decisions.

Key Support and Resistance Levels

Support and resistance levels are crucial points on a price chart where the price is likely to find either buying or selling pressure. Identifying these levels can help traders anticipate potential reversals or continuations of trends. These levels are derived from past price action, and their accuracy depends on the strength of historical price data. Determining these levels involves observing significant highs and lows in the price chart.

Technical Indicators

Various technical indicators are employed to gauge the momentum and strength of price movements. These indicators provide quantitative measures of market sentiment and can help identify potential turning points in the market. A comprehensive understanding of these indicators enhances the ability to anticipate price movements.

- Moving Averages (MA): Moving averages smooth out price fluctuations, revealing the overall trend direction. Short-term moving averages highlight short-term trends, while longer-term averages indicate the broader trend. For example, a crossover of a 20-day moving average over a 50-day moving average might signal a bullish trend.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI value above 70 often suggests an asset is overbought, while a value below 30 indicates it might be oversold. This indicator can be used to identify potential reversals.

- Bollinger Bands: Bollinger Bands show price volatility, using standard deviations to Artikel a band around a moving average. Expansions in the bands often signify increased volatility, while contractions suggest decreased volatility. This indicator helps identify periods of potential price bursts or consolidation.

- Volume: Volume is a crucial indicator of market sentiment. Increased volume accompanying price movements often suggests greater conviction in the trend. This can provide insight into the strength and sustainability of the current trend.

Candlestick Patterns

Candlestick patterns offer visual representations of price action over a specific period. Understanding these patterns can provide insight into potential future price movements. These patterns are identified based on the body and wicks (shadows) of the candlesticks.

- Hammer: A hammer candlestick pattern signals a potential reversal from a downtrend to an uptrend. It is characterized by a small real body with a long lower shadow. This suggests a significant buying pressure at the support level.

- Engulfing Pattern: An engulfing pattern occurs when one candlestick completely engulfs the previous candlestick. This can indicate a significant shift in market sentiment. A bullish engulfing pattern suggests a potential uptrend, while a bearish engulfing pattern signals a potential downtrend.

- Doji: A doji candlestick is characterized by a small body with almost equal upper and lower shadows. It often signals indecision in the market and a potential reversal or continuation of the trend. The direction of the subsequent candlestick often determines the continuation or reversal of the trend.

Bitcoin Technical Indicators List

- Moving Averages (e.g., 50-day, 200-day)

- Relative Strength Index (RSI)

- Bollinger Bands

- Volume

- Candlestick Patterns (e.g., Hammer, Engulfing, Doji)

Understanding Cryptocurrency Fundamentals

.06 on April 14, 2017. Why? : r/Bitcoin” title=”Coinbase showing Bitcoin price at

.06 on April 14, 2017. Why? : r/Bitcoin” title=”Coinbase showing Bitcoin price at  .06 on April 14, 2017. Why? : r/Bitcoin” />

.06 on April 14, 2017. Why? : r/Bitcoin” />Cryptocurrencies, a relatively recent phenomenon, have rapidly gained traction as an alternative form of digital money. Understanding their underlying principles is crucial for anyone seeking to navigate this dynamic market. This section delves into the core characteristics of cryptocurrencies, emphasizing the role of blockchain technology, exchange types, mining processes, and the diverse range of cryptocurrencies available.

Fundamental Characteristics of Cryptocurrency

Cryptocurrencies are digital or virtual currencies designed to work as a medium of exchange. They leverage cryptography for security and operate independently of central banks or governments. Key features include decentralization, transparency, and immutability. These characteristics differentiate them from traditional fiat currencies.

Blockchain Technology and Its Role

Blockchain technology is the foundational framework underpinning most cryptocurrencies. It’s a distributed, immutable ledger that records transactions across multiple computers. This distributed nature ensures security and transparency, as no single entity controls the data. Each block in the chain contains a set of transactions, linked cryptographically to the previous block, forming a chronological and tamper-proof record.

Centralized vs. Decentralized Exchanges

Centralized exchanges (CEXs) are platforms where users buy, sell, and trade cryptocurrencies. These exchanges operate under the control of a single entity, offering convenience and often providing additional services like custodial wallets. Decentralized exchanges (DEXs), on the other hand, operate on blockchain technology, enabling peer-to-peer transactions without intermediaries. DEXs typically require users to hold cryptocurrencies in their own wallets.

Cryptocurrency Mining

Cryptocurrency mining is a process used to validate and add new transactions to the blockchain. Miners use specialized hardware to solve complex mathematical problems. The successful miner receives a reward in the cryptocurrency. The mining process ensures security and maintains the integrity of the blockchain.

Different Types of Cryptocurrencies

Numerous cryptocurrencies exist, each with unique characteristics and functionalities. Here’s a brief overview of some prominent types:

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin operates on a decentralized network and is often used as a store of value.

- Ethereum (ETH): Ethereum is a platform for decentralized applications (dApps) and smart contracts, leveraging its blockchain technology for a wide range of functionalities beyond just transactions.

- Stablecoins: These cryptocurrencies aim to maintain a stable value pegged to a fiat currency, like the US dollar, reducing the volatility inherent in other cryptocurrencies.

- Altcoins: This term encompasses all cryptocurrencies besides Bitcoin and Ethereum. This diverse group includes numerous projects with varying functionalities, often targeting specific needs or industries.

Bitcoin and Regulations

The regulatory landscape surrounding Bitcoin and cryptocurrencies is constantly evolving, presenting both opportunities and challenges for investors. Navigating these complexities is crucial for understanding the long-term viability and potential of this burgeoning market. This section delves into the current regulatory environment, its impact on Bitcoin’s price on Coinbase, and the diverse regulatory bodies involved.

Current Regulatory Environment

The current regulatory environment for Bitcoin and cryptocurrencies is fragmented and often inconsistent across jurisdictions. Many countries are still developing specific frameworks for digital assets, leading to uncertainty and varying levels of acceptance. Some countries have embraced cryptocurrencies with regulatory sandboxes or clear guidelines, while others remain cautious or even hostile. This lack of uniformity can significantly impact investment strategies and trading activities on platforms like Coinbase.

Impact of Regulatory Changes on Bitcoin’s Price on Coinbase

Regulatory changes, whether positive or negative, can have a substantial impact on Bitcoin’s price on Coinbase. For instance, positive developments like regulatory clarity and acceptance can lead to increased investor confidence and a surge in trading volume, positively affecting the price. Conversely, negative developments, such as stricter regulations or outright bans, can create uncertainty and potentially lead to price declines.

Regulatory Bodies Involved in Cryptocurrency Regulation

Numerous regulatory bodies are involved in shaping the cryptocurrency regulatory environment. These bodies include central banks, securities commissions, and financial regulators. For example, the US Securities and Exchange Commission (SEC) plays a significant role in defining the regulatory framework for cryptocurrencies in the United States. The European Union’s regulatory bodies are also active in establishing common guidelines for cryptocurrencies across the member states.

Different regulatory approaches can significantly influence the cryptocurrency market.

How Regulatory Changes Affect Cryptocurrency Trading on Coinbase

Regulatory changes directly impact cryptocurrency trading on Coinbase and other platforms. For example, new regulations might introduce stricter KYC (Know Your Customer) procedures, leading to longer verification times and potential limitations on certain trading activities. Restrictions on certain cryptocurrencies or trading pairs can also limit investor choices and market liquidity. Compliance with evolving regulations is paramount for maintaining platform integrity and investor trust.

Comparison of Regulatory Frameworks Across Different Countries

Regulatory frameworks for cryptocurrencies vary significantly across different countries. Some countries have adopted a more permissive approach, allowing for broader innovation and market participation. Other countries have adopted a more cautious approach, imposing stricter controls and limitations. The US, for example, has a complex regulatory landscape with various agencies involved, while some countries have adopted a more comprehensive framework for digital assets.

Understanding these differences is crucial for investors seeking to participate in the global cryptocurrency market.

Bitcoin Price Prediction and Future Trends

Predicting the future price of Bitcoin, or any cryptocurrency, is inherently challenging. While various analysts offer forecasts, these are often based on complex models and assumptions. The volatility of the cryptocurrency market and the unpredictable nature of technological advancements make precise predictions unreliable. Nevertheless, examining different perspectives and underlying factors can provide valuable insight into potential future trends.

Forecasts of Bitcoin’s Future Price on Coinbase

Analysts offer diverse price forecasts for Bitcoin on Coinbase. Some project significant growth, potentially reaching new all-time highs. Others predict a more moderate increase or even a period of consolidation. The range of these forecasts reflects the inherent uncertainty in the market. It’s important to remember that these are not guarantees but rather informed opinions based on current market conditions and various factors.

Factors Affecting Future Price Predictions

Several key factors influence price predictions for Bitcoin on Coinbase. Market sentiment, including investor confidence and adoption rates, plays a critical role. Technological advancements, such as the development of new blockchain technologies or the emergence of innovative applications, can significantly impact Bitcoin’s value proposition. Government regulations, both positive and negative, also significantly affect the price. For example, favorable regulations could increase investor confidence and adoption, while restrictive regulations could have the opposite effect.

Role of Technological Advancements in Shaping Future Trends

Technological advancements are crucial in shaping Bitcoin’s future price trends. The development of new blockchain technologies, potentially improving scalability and efficiency, can enhance Bitcoin’s value proposition. The integration of Bitcoin into mainstream financial systems, such as its use in payment processing or investment products, can also influence its price. For instance, the introduction of Bitcoin-based payment systems could drive wider adoption and increase demand.

Possible Implications of Future Regulations

Future regulations will undoubtedly play a significant role in shaping Bitcoin’s future price trends. Favorable regulations, such as clear guidelines for use and trade, could boost investor confidence and promote adoption. Conversely, restrictive regulations, including outright bans or severe restrictions, could negatively impact Bitcoin’s value and trading volume. The impact will depend on the specific regulations and their implementation.

Projected Future Prices of Bitcoin on Coinbase

| Year | Projected Price (USD) | Analyst/Source | Notes |

|---|---|---|---|

| 2024 | $35,000 | Market Analyst A | Based on projected growth and market sentiment |

| 2024 | $40,000 | Market Analyst B | Assumes increased adoption and positive regulatory developments |

| 2025 | $50,000 | Market Analyst C | Forecasts sustained growth driven by technological advancements |

| 2026 | $60,000 | Market Analyst D | Predicts increased institutional investment |

Note: These are illustrative projections and should not be interpreted as financial advice. The actual price may vary significantly from these forecasts.

Ending Remarks

In conclusion, Bitcoin’s price on Coinbase is a dynamic and complex subject, shaped by numerous intertwined factors. Understanding its past movements, the current market environment, and the potential for future trends is crucial for anyone interested in investing in or following Bitcoin. This analysis provides a robust framework for understanding Bitcoin’s price fluctuations within the context of the broader cryptocurrency market and Coinbase’s specific trading platform.

Helpful Answers

What are the common order types available for Bitcoin trading on Coinbase?

Coinbase offers various order types, including market orders, limit orders, and stop-loss orders. Market orders execute immediately at the current market price, while limit orders allow you to specify a desired price at which you want to buy or sell. Stop-loss orders automatically sell your Bitcoin if the price drops below a certain level.

How does Bitcoin’s price on Coinbase relate to other major cryptocurrency exchanges?

A table comparing Bitcoin’s price performance on Coinbase to other major exchanges would be beneficial to demonstrate the price correlation.

What are the key technical indicators for predicting Bitcoin price movements?

Several technical indicators, such as moving averages, RSI, and MACD, can be used to predict Bitcoin’s price movements. These indicators are often used in conjunction with charts from Coinbase to identify potential support and resistance levels.

What are the different types of cryptocurrencies?

Cryptocurrencies are categorized based on various factors. Some are based on proof-of-work consensus mechanisms, while others use different methods. The underlying technology, community, and use cases further differentiate them. An overview of common types, like Ethereum, Litecoin, and Ripple, would be helpful.